Because of how large and complex our world is we all have a single number that represents (at that point in time) how likely you are to pay back the money you borrow. This number is then used to decide if a bank will lend you money and if they do how much they will charge you to borrow it. This is one of the most frustrating parts of our society today is trying to get loans and understanding what our credit score has to do with it especially if you are young. That number is your financial batting average better known as your credit score.

Okay, so what? Why should I care about that? Well, you should care because it ultimately affects whether you will get a loan when you want to buy a car, house, or need a credit card. It also affects how much you will pay for these services which will dramatically affect how much more or less you pay to borrow the same amount of money. Simply you should care about your credit score and you should get it as high as you can because when you need to borrow money you want the best deal possible.

Think of your credit score like your batting average in baseball (for non-sports fans it tracks how many times you hit the ball vs your total opportunities or at-bats). So when you are young you have no batting average because you’ve never had a chance to hit the ball (borrow money) and get a hit (pay it back).

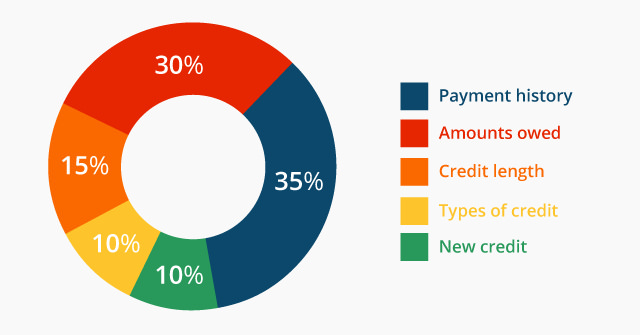

Simply the more at-bats you have (borrow money) and the more times you get a hit (make an on-time payment) the higher your batting average or credit score. There are a lot of factors that will impact your credit score but at its core, this is the basis for your financial batting average.

Now when you are young and starting out in life you have no track record of your trustworthiness when it comes to paying back the money. All your credit score represents is if you are more or less likely to pay back the money you borrow. Just like in baseball you don’t assume a first-time major leaguer in their first at-bat will hit a home run. Who knows they could be the next Derek Jeter or a total bust who is sent back down to the minor leagues tomorrow. This is what makes it difficult for young folks starting out to get loans and credit cards because our financial system doesn’t trust first time players are going to get a hit. Credit scores may not matter to you this second but long-term it will have a major effect on you when you finally do want to buy a house, a new car, or even refinance your student loans. I encourage teenagers and more likely young adults to be smart with their credit and stack the deck in their favor.

See my next post about 1 simple credit hack that EVERYONE should utilize if you are trying to build credit when you are young or if you are 65 and had a couple financial strikeouts. It’s never too late to increase your batting average.

See other posts:

Cryptocurrency Meet Up – Bitcoin & the Blockchain

[…] Your Financial Batting Average […]

[…] Your Financial Batting Average […]

[…] Your Financial Batting Average […]

Comments are closed.