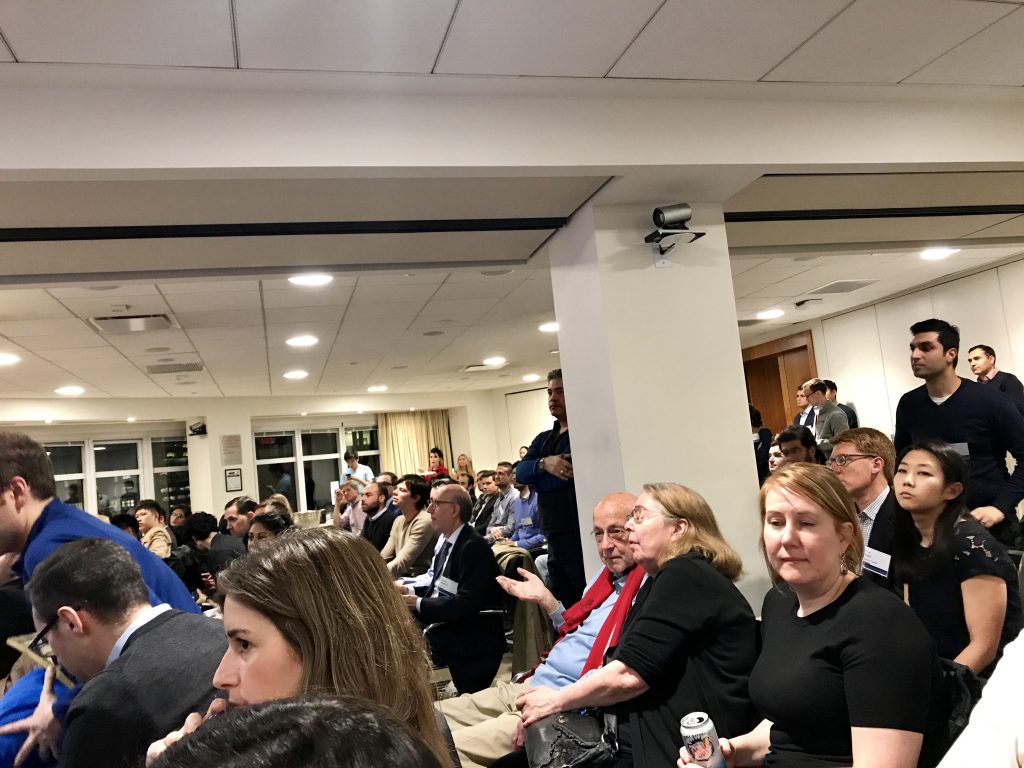

The 2019 FinTech trends meetup I attended in January highlights how hot FinTech is. According to an Accenture report, global FinTech investment hit $55 Billion worldwide. That is up double from last year’s total.

The 2019 FinTech trends meetup I attended in January highlights how hot FinTech is. According to an Accenture report, global FinTech investment hit $55 Billion worldwide. That is up double from last year’s total.

So what exactly is FinTech and what are the important trends to understand besides the rise in investment dollars?

What is FinTech?

FinTech is a category of technology companies that focus on providing technology solutions in the banking, investment, and financial sector. For example, Robinhood is a FinTech company that is a digital trading platform, which removes the fees for basic stock trading. It is disrupting the entrenched investment banks that charge brokerage fees for stock trading.

FinTech is a sector that is growing rapidly with heavy investment from Venture Capital (VC), Private Equity (PE), and Corporate VC/PE. The types of companies range from banking and investment platforms to payment verification platforms (i.e. Stripe) to, yes, cryptocurrencies and blockchain.

Oh like Uber?

Technology companies that are not considered FinTech include Instagram, Lyft, and Uber. While they are technology companies, they do not fall into the financial services sector. There are other categories of technology companies such as MarTech (marketing), AdTech (advertising), HR Tech (Human Resources), InsurTech (insurance), AgTech (Agriculture), etc. Essentially, the trend is technology is really starting to be a key driver of innovation in all industries.

Back to the 2019 FinTech trends meetup…

The 2019 FinTech trends meetup I attended in NYC was through Empire Startups and hosted by Latham & Watkins. The individuals on the panel included Perry Rahbar, founder & CEO of dv01; Luan Cox, Founder & CEO of FinMkt; Jon Stevenson, head of investments at MoneyLion; and Adam Grealish, director of investments at Betterment. The moderator was Doug Nelson, from Long Ridge Equity Partners.

The panel conversation ranged from very technical discussions about business and financial models (yawn) to the future of the industry. Within the macro trends like the larger flow of capital into FinTech, there were some not so obvious trends.

1. Average Retail Investor is Getting Smarter

In 2019 the average investor is smarter and savvier than in the past. So what has changed? Access to information with the internet has really expanded. People are able to more easily educate themselves. Additionally, financial content has gotten better. Every player in the financial sector is producing higher quality content and the best content producers are meeting people where they are at with easier to digest information.

2. The number of accounts opened has increased with digital first platforms

The second 2019 FinTech trend is that the sheer number of accounts has risen drastically as a result of digital platforms. Consumers are now able to open accounts with greater ease than ever before. I have many accounts as it is easy to split my money into separate accounts for different purposes. I have accounts dedicated to family savings, travel, business investing, emergency, retirement, and brokerage. Digital banking has made it easier than ever to create new accounts and reduced the cost to institutions to maintain those accounts.

3. A ton of new FinTechs

As the momentum builds in FinTech, more new companies continue to be created. The cycle of rising investment plus the entry of corporate investment funds (big banks now have their own investment arms) has led to more new companies. That being said there is a trend towards consolidation as these smaller FinTechs are bought up once they have a proven track record. More new startups and as companies mature there is a consolidation that is occurring.

4. Banks are making bets on FinTechs that can prove they will be around

Traditional banks do not want to end up like Blockbuster or ToysRUs. As such, they are both acquiring and investing in promising FinTechs as both a hedge (to ensure they don’t get disrupted) and as a growth engine. The trailblazers in the FinTech space have helped pave the way for other FinTech companies and banks do not want to be left behind.

So should I buy bitcoin? It’s the only reason I read this 2019 FinTech trends article…

The 2019 FinTech trends panel didn’t touch on cryptocurrency and blockchain. JP Morgan Chase announced a new internal cryptocurrency that is pegged to the dollar. The goal is to enable more immediate transactions for their wholesale corporate customers. Most people agree that blockchain will have a profound impact on the long-term. Yet, it is difficult to say which cryptocurrencies will become widely adopted.

Ben Horowitz of Andreessen Horowitz a major VC firm has made a lot of bets on blockchain technology. On the NPR Planet Money Podcast, he made a bet in 2014 about the future adoption of Bitcoin. While he lost the bet, his firm made lots of money investing in blockchain companies. He himself isn’t so sure about bitcoin being the winner but is putting his money where his mouth is when it comes to the rise of crypto long-term.

In conclusion, the 2019 FinTech trends meetup highlighted both macro trends and more nuanced changes for consumers. If you haven’t already noticed FinTech companies creeping into your daily life, it is likely you will soon. I encourage you to go find your own FinTech trends meetup and learn about how the industry is evolving in 2019.

More posts…

Growth Hacking Tools for Startups